One of the most critical decisions facing homebuyers in India’s dynamic real estate market is choosing between under-construction and ready-to-move properties. This choice goes far beyond simple preference—it impacts your finances, lifestyle, risk exposure, and investment returns. In 2025, with RERA regulations strengthening transparency and buyer confidence, both options present compelling advantages depending on your circumstances. According to recent surveys, buyer preference for ready-to-move and under-construction homes has nearly equalized, reflecting how both segments offer distinct value propositions. Understanding the practical implications, financial differences, and risk-reward dynamics of each option will help you make a decision that aligns perfectly with your goals, timeline, and budget.

Understanding Both Property Types:

Before diving into comparisons, let’s clarify what each term means. Under-construction properties are projects still in the building phase where buyers make payments in stages linked to construction milestones until final possession. These properties are typically priced lower and offer customization opportunities but come with timeline uncertainties. Ready-to-move properties are fully constructed homes with all necessary approvals, occupancy certificates, and immediate possession availability. While they command premium pricing, they eliminate construction delays and provide instant gratification for those needing immediate accommodation or rental income.

Key Advantages of Under-Construction Properties:

- Significantly Lower Pricing: Under-construction properties typically cost 10-30% less than equivalent ready-to-move options in the same location, making them highly attractive for first-time buyers and long-term investors. This pricing advantage allows buyers to access premium locations and larger configurations that might otherwise be financially out of reach. Developers offer pre-launch discounts, early-bird schemes, and attractive payment plans that further reduce the effective cost.

- Higher Appreciation Potential: Property values tend to increase progressively as construction advances and surrounding infrastructure develops. Buyers who enter at early stages can capture significant appreciation by possession time. In growing areas, under-construction properties have demonstrated 12-18% annual appreciation compared to 6-10% for ready-to-move homes in mature locations. This appreciation differential makes under-construction properties particularly attractive for investors focused on capital gains rather than immediate usage.

- Flexible Payment Plans: One of under-construction properties’ biggest financial advantages is the construction-linked payment plan. Instead of arranging the entire property cost upfront, buyers pay in installments spread across 2-4 years as construction progresses. This staged payment structure eases immediate financial burden and allows buyers to manage cash flow more effectively, especially beneficial for salaried professionals managing multiple financial commitments simultaneously.

- Customization Opportunities: Many developers allow buyers of under-construction properties to customize interiors, choose flooring materials, select paint colors, and sometimes even modify internal layouts within structural constraints. This personalization ensures your home reflects your taste and lifestyle requirements rather than accepting a developer’s standard finishes. Such customization is virtually impossible with ready-to-move properties where everything is pre-decided and completed.

- Modern Amenities and Design: New under-construction projects typically incorporate contemporary architectural trends, smart home features, energy-efficient systems, and lifestyle amenities that older ready properties may lack. Developers design these projects keeping current buyer preferences in mind—spacious balconies, open kitchens, abundant natural light, and comprehensive clubhouse facilities that enhance quality of life.

Significant Risks Associated with Under-Construction Properties:

- Possession Delays: Despite RERA regulations mandating timely delivery, project delays remain a persistent challenge. Nearly 40% of under-construction properties in major Indian cities experience delivery delays due to labor shortages, supply chain disruptions, financial issues, or regulatory hurdles. These delays can disrupt life plans, force extended rental accommodation, and create financial stress from dual rent-EMI payments.

- GST Liability: Under-construction residential properties attract 5% GST (1% for affordable housing under specified caps), adding to the overall cost. This tax is not applicable to ready-to-move properties with occupancy certificates, creating a price differential that partially offsets the lower base price of under-construction units.

- Developer Risk: Not all developers maintain high credibility or financial stability. Projects can face fund diversion issues, quality compromises, or even abandonment if builders encounter financial difficulties. Thorough due diligence on developer track record, RERA registration verification, and financial health assessment become critical to mitigate this risk.

- Delayed Tax Benefits: Home loan interest deduction under Section 24(b) cannot be claimed during construction—it’s allowed post-possession in five equal installments. Similarly, principal repayment deductions under Section 80C are available only after taking possession. This delayed benefit reduces immediate tax savings compared to ready-to-move properties where deductions start immediately.

Compelling Advantages of Ready-to-Move Properties:

- Immediate Possession and Certainty: The single biggest advantage is instant possession—you can move in immediately or start generating rental income without waiting. There’s zero uncertainty about possession dates, no construction delays, and no anxiety about project completion. This certainty is invaluable for families needing immediate accommodation, NRIs making overseas investments, or investors seeking quick rental returns.

- Physical Inspection and Quality Verification: You can personally inspect every aspect—construction quality, actual room sizes, natural light, ventilation, view, neighborhood ambiance, and overall finishing. This physical verification eliminates the risk of reality not matching brochure promises, ensuring you know exactly what you’re paying for before committing.

- No GST Liability: Ready-to-move properties with valid occupancy certificates are exempt from GST, providing immediate cost savings. You only pay stamp duty and registration charges, making the total cost more predictable and often comparable to under-construction properties when GST is factored in.

- Immediate Tax Benefits: Home loan interest and principal repayment tax deductions are available immediately from the first financial year post-purchase. You can claim up to ₹2 lakh annually on interest under Section 24(b) and ₹1.5 lakh on principal under Section 80C, providing significant tax relief right away.

- Established Neighborhood and Infrastructure: The surrounding area is fully developed with functional amenities—schools, hospitals, markets, public transport, and social infrastructure are already operational. You know exactly what lifestyle the location offers, with no uncertainty about promised infrastructure materializing or not.

- Better Rental Yields: For investors, ready-to-move properties start generating rental income immediately. In major Indian cities, rental yields for ready properties range from 3-5% annually, providing steady cash flow while the property appreciates. Under-construction properties cannot generate any rental income until possession, representing years of lost opportunity cost.

Disadvantages of Ready-to-Move Properties:

- Higher Purchase Price: Ready-to-move properties command 10-30% premium over under-construction alternatives in the same locality, requiring higher upfront capital or larger loans. This premium reflects the developer’s completed investment and the buyer’s benefit of certainty.

- Limited Appreciation Potential: Since these properties are already completed, short-term appreciation tends to be more modest compared to under-construction units that benefit from progressive value addition during construction phases.

- Limited Customization: What you see is what you get—there’s minimal scope for personalization except perhaps repainting or minor modifications. If you have specific design preferences, you’ll need to undertake renovations post-purchase, adding to costs.

2025 Market Dynamics and Buyer Preferences:

India’s real estate sector witnessed 372,936 units launched in 2024—a 6.33% increase from 2023—with sales hitting a 12-year high of 350,612 units. This robust activity indicates strong buyer confidence in both segments. However, buyer behavior has noticeably shifted post-pandemic toward ready-to-move properties due to possession certainty, rising rental opportunities, and reduced tolerance for construction delays. Cities experiencing rapid infrastructure development see strong demand for under-construction projects in emerging corridors, while established neighborhoods favor ready-to-move transactions. RERA’s enforcement and transparent project tracking have significantly improved trust in under-construction properties, making them viable again for cautious buyers who previously avoided them due to completion risks.

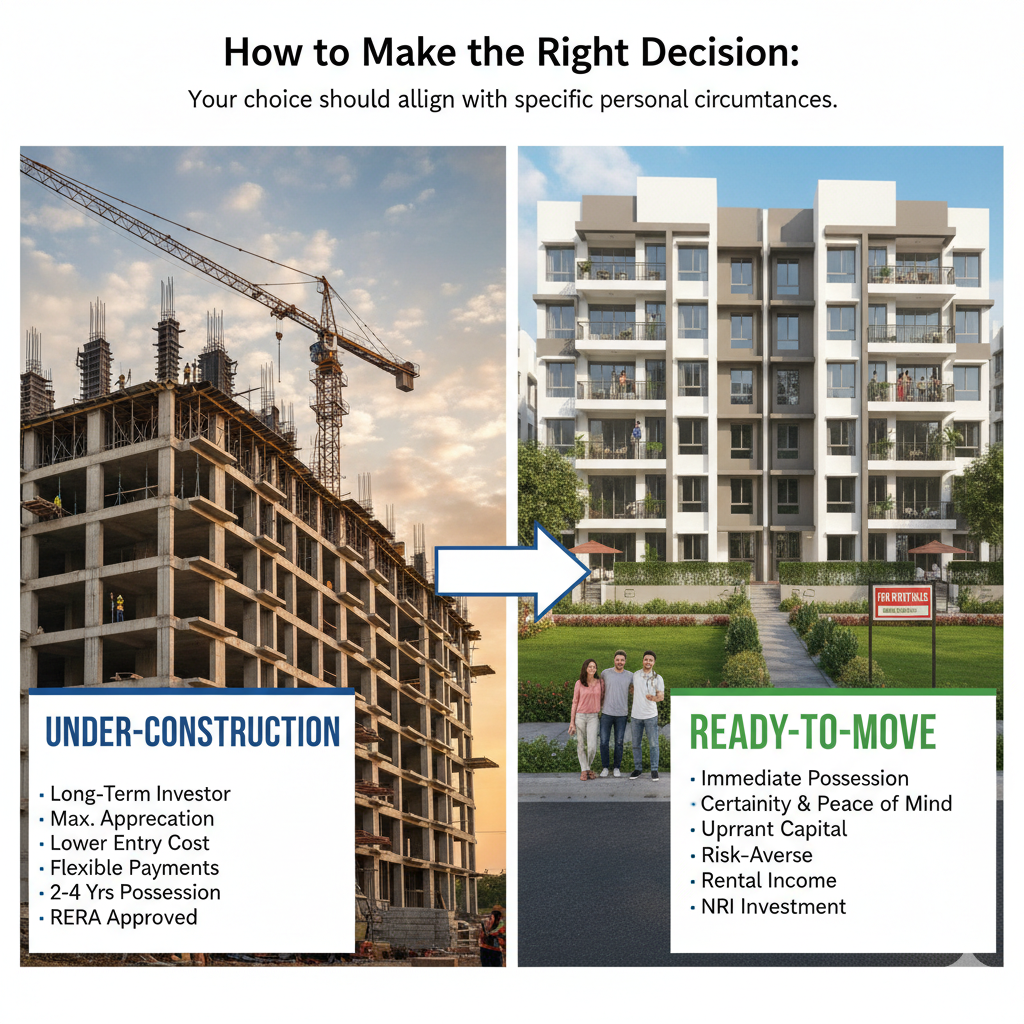

How to Make the Right Decision:

Your choice should align with specific personal circumstances. Choose under-construction if you’re a long-term investor comfortable waiting 2-4 years for possession, seeking maximum appreciation potential, have budget constraints requiring lower entry costs and flexible payments, don’t need immediate accommodation, and can tolerate some uncertainty with reputed RERA-registered developers. Choose ready-to-move if you need immediate possession for personal use or rental income, prioritize certainty and peace of mind over potential savings, have sufficient upfront capital or approved financing, are risk-averse regarding project delays, or are an NRI making overseas investments requiring immediate tangible assets.

Critical Checks Before Buying Either Property Type:

Regardless of your choice, conduct thorough due diligence. For under-construction properties, verify RERA registration and quarterly progress reports, check developer’s track record and past project delivery timelines, review all legal approvals and clearances, inspect the site personally to assess construction quality and progress, understand payment structure and penalty clauses for delays, and ensure escrow account compliance for fund protection. For ready-to-move properties, verify occupancy certificate and completion certificate authenticity, conduct thorough physical inspection for construction quality and defects, check property age and residents’ feedback on maintenance, verify all legal documents including clear title and tax compliance, assess the building’s structural health and maintenance standards, and ensure society formation and common area conveyance are completed.

The Smart Approach:

There’s no universally superior choice—both under-construction and ready-to-move properties serve different buyer profiles effectively. The smartest buyers in 2025 are those who match property type to their specific situation rather than following market trends blindly. If you value certainty, immediate use, and rental income, ready-to-move delivers. If you seek affordability, appreciation potential, and can manage timeline uncertainty, under-construction offers compelling value. Always prioritize RERA-registered projects with credible developers, conduct comprehensive due diligence, factor in all costs including taxes and hidden charges, and align your decision with your financial capacity, lifestyle needs, and investment horizon. The right property isn’t necessarily the cheapest or the most premium—it’s the one that fits your unique circumstances and helps you achieve your homeownership or investment goals successfully.